Why Housing Crashes Don’t Just Happen: A Seasoned Realtor’s Perspective on Market Stability

Is the housing market about to crash? I hear this question a lot, and with all the mixed signals out there, I understand why people are concerned.

But here’s the truth: housing crashes don’t happen overnight.

I’ve been in real estate since 1998, and I’ve seen the market go through its ups and downs. But not every dip signals disaster. Let’s break it down.

The Numbers Tell a Different Story

Some headlines suggest a slowdown in sales, but that doesn’t mean prices are plummeting.

According to the latest NAR report:

📈 Home prices nationally are up 4% year over year

📈 In Santa Clara County, prices have risen 8.5%!

So no, we’re not seeing a crash—just a shift in market activity.

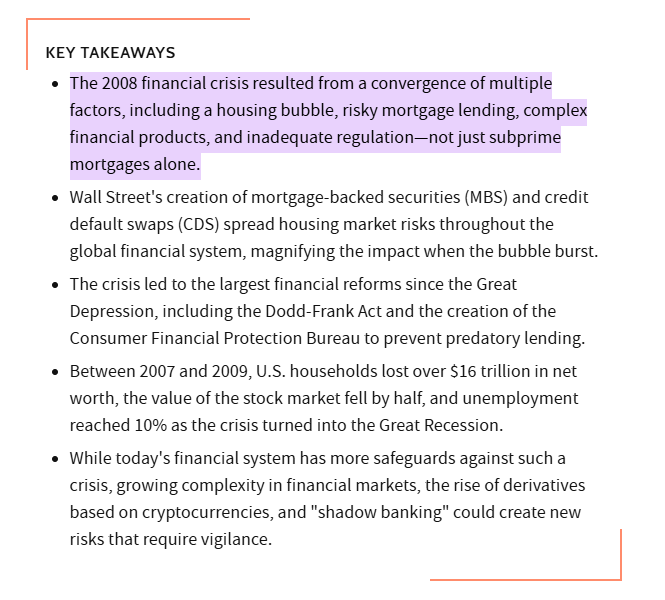

Why 2008 Was Different

Remember the 2007-2011 housing crash? That was a perfect storm of economic disasters:

✔️ Distressed Sellers & Foreclosures – Homeowners were forced to sell at a loss.

✔️ Underwater Mortgages – Many owed more than their homes were worth.

✔️ Recession & Job Losses – The economy tanked, and people couldn’t afford their mortgages.

✔️ Credit Markets Collapsed – Lenders stopped approving loans.

🚨 But here’s the key: That crash took years to unfold.

Today’s market looks nothing like that.

What’s Different in 2024?

✅ Low Housing Supply – We’re seeing historically low new listings, keeping prices stable.

✅ No Distressed Selling – Foreclosures aren’t flooding the market. Most sellers are also buyers, keeping the cycle moving.

✅ Job Market & Housing – Job losses don’t automatically crash real estate. In 80+ years of data, it’s only happened once—when credit markets were already failing.

🎯 The Bottom Line: No Panic Needed

The real estate market naturally ebbs and flows—but that doesn’t mean we’re heading for a repeat of 2008.

So before jumping to conclusions based on headlines, remember:

✔️ Look at the full picture

✔️ Understand supply and demand

✔️ Stay informed with real data

Want to know what’s happening in YOUR neighborhood?

Stay tuned for my quarterly market update next week, where I’ll break down the latest local trends!

.png)

.png)

.png)

.png)

.png?w=128&h=128)