Don’t Get Caught Off Guard: Closing Costs Explained for Bay Area Buyers

Hi everyone, I'm Keith Walker, a seasoned realtor with years of experience helping clients navigate the real estate market in the Bay Area.

When buying a home, many people focus on saving for their down payment, but it’s important to remember that there are additional costs involved—known as closing costs—that can catch you off guard if you're not prepared.

.png?w=1140)

Closing costs are the expenses paid at the end of a real estate transaction, separate from your down payment. Nationally, buyers should expect to pay between 2% and 5% of the purchase price, but here in the Bay Area, where property values are higher, the dollar amount can be significantly greater.

In our region, it’s common to budget between $10,000 and $15,000 in closing costs. But depending on your transaction, this number can increase.

.png?w=1140)

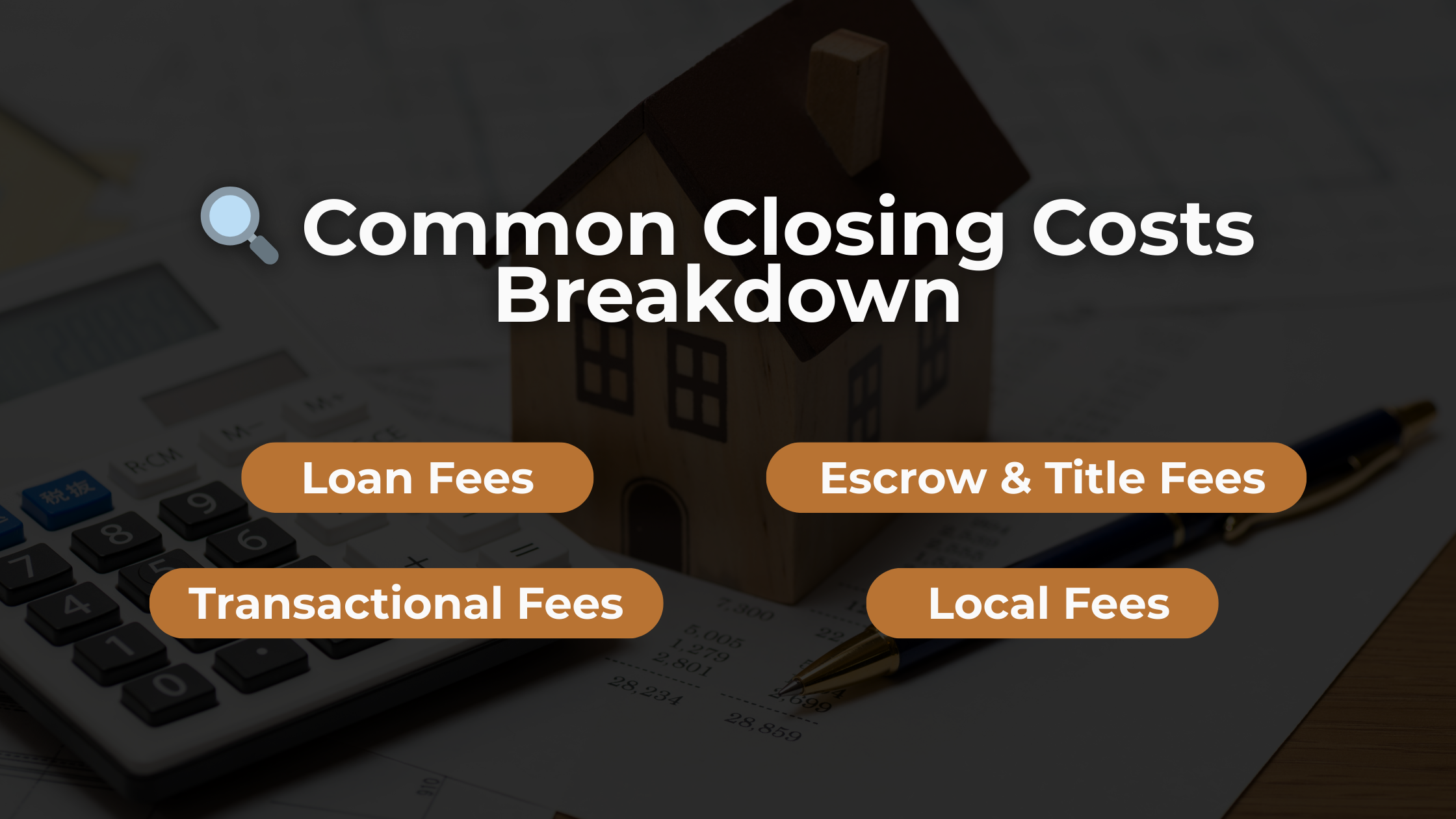

🏦 Loan Fees

Processing Fee

Loan Origination Fee

Prepaid Interest

Appraisal Fee

📝 Escrow & Title Fees

Title Insurance (Lender's Policy)

Notary Fees

Courier Fees

Loan Tie-In Fees

🌆 Local Fees

Sewer Line Testing

City Transfer Tax

📑 Transactional Fees

Homeowner's Insurance (Prepaid for 1 Year)

Property Tax Prorations

HOA Dues/Association Prorations

County Recording Fees

.png?w=1140)

Buying points to lower your interest rate

Sellers having prepaid property taxes far in advance

Requirements for specialty insurance (e.g., flood, fire hazard, or earthquake)

Remember, national averages don’t always apply here in the Bay Area. It's crucial to work with a knowledgeable local realtor who can guide you through the real costs of homeownership.

If you have any questions or want to know exactly what you can expect based on your budget and property type, reach out to me directly. I’m here to make sure you’re informed, prepared, and confident every step of the way.

Thanks for reading, and I look forward to helping YOU achieve your real estate goals!

.png?w=1140)

Stay Ahead of the Market!

Before we dive in, make sure you’re following me for real-time market insights, expert analysis, and tips for navigating today’s housing market.

📍 If you're in the San Diego or Bay Area and need someone who knows the ropes, let’s connect.

.png)

.png)

.png)

.png)

.png?w=128&h=128)