April 2025 Santa Clara Real Estate Market Update: Is the Market Just on Pause?

Welcome to a special edition of our quarterly market update for Santa Clara County—and this time, we’re coming to you ahead of schedule.

There are a lot of headlines, market whispers, and consumer nerves being tested right now, so let’s address the question on everyone’s mind: Are we in a market shift or simply on pause?

.png?w=1140)

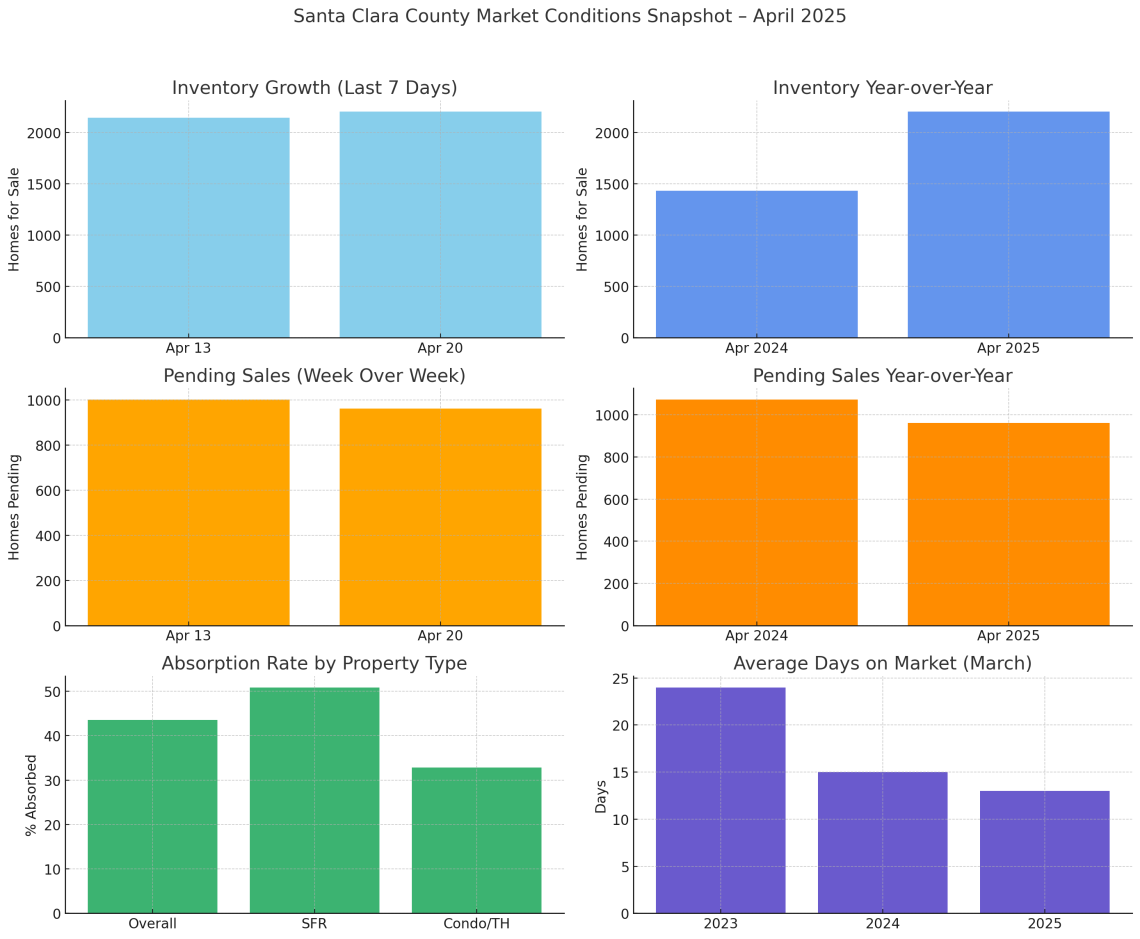

📈 Inventory

Total homes for sale (April 20, 2025): 2,204 (up from 2,144 last week)

Compared to last year: Up from 1,433—significantly healthier than 2024’s inventory drought

🏡 Pending Sales

Total: 962 (down 4% from 1,002 last week and down from 1,073 a year ago)

Despite economic volatility, pending sales have remained steady over the past month

📊 Absorption Rate

Overall: 43.6%

Single-family homes: 50.9%

Townhomes/condos: 32.8%

Compared to last year’s 75%, this shows a more balanced market—healthy for single-family homes, buyer-friendly for condos/townhomes

⏱️ Average Days on Market

March average: 13 days (similar to 15 last year, faster than 24 two years ago)

💰 Home Prices

Average Price (March): $2,592,942 (up 16% from January)

Average Price/Sq Ft: $1,306 (up 21% since November 2022)

Stay Ahead of the Market!

Before we dive in, make sure you’re following me for real-time market insights, expert analysis, and tips for navigating today’s housing market.

.png?w=1140)

While the news headlines create uncertainty, the underlying data remains strong. Inventory is rising slightly as expected during spring, but there’s no flood of panicked sellers.

🟨 Market Sentiment: Paused, Not Crashed

We’re not on the edge of a housing crash. Let’s remember:

In 2008, inventory was over 16,000 homes—now it's just over 2,000

Most homeowners today have sub-4% mortgage rates and high equity

Sellers are choosing to hold rather than list under pressure

This means: prices will hold steady.

💡 Opportunities (and Missteps) for Sellers

Some sellers are listing low to trigger bidding wars. But with fewer active buyers right now, this strategy can backfire—leading to lower-than-expected sales prices.

Advice for Sellers:

Don’t panic-sell

Make your home stand out

Use smart pricing and strong marketing to attract serious buyers

🏆 Opportunity for Buyers

If you’re a buyer waiting on the sidelines—this is your window.

Investors are acting. In fact, their absorption rate is 20% higher than the average buyer’s. That should tell you something. As soon as positive news hits, expect buyer activity—and prices—to surge again.

Think back to the "pandemic pause" and the frenzy that followed. We may be headed toward a light version of that.

📅 What to Expect Next

We may see the spring market momentum shift into Q3

A slight dip in appreciation is possible for April, but year-over-year growth remains strong

Expect continued updates monthly as the market remains fluid

.png?w=1140)

This market isn’t broken—it’s adjusting. And that’s not a bad thing.

If you're looking for a one-on-one analysis of how current trends impact your goals, or if you're considering buying or selling in Santa Clara County, reach out to my team and me.

🗓️ And don’t forget: Join us at our upcoming Seller’s Workshop on May 10th, where I’ll be diving deep into this market update and much more.

Until next time—educating and navigating, not speculating or fabricating.

– Keith Walker

📍 If you're in the San Diego or Bay Area and need someone who knows the ropes, let’s connect.

.png)

.png)

.png)

.png)

.png?w=128&h=128)