Unlock Hidden Savings: How California Homeowners 55+ Can Slash Their Property Taxes When Moving

For many homeowners in California, rising property taxes can be a significant concern when considering a move. However, homeowners aged 55 and older, individuals with severe disabilities, and those affected by natural disasters may be eligible for substantial tax savings through Propositions 19, 60, and 90.

These propositions allow eligible individuals to transfer their existing property tax base when purchasing a new home, potentially saving thousands of dollars annually. Understanding how these laws work can help homeowners make informed decisions about their next move.

Understanding Property Tax Transfers in California

When a homeowner purchases a new home, property taxes are typically reassessed based on the current market value. Given California’s escalating real estate prices, this reassessment can result in significantly higher tax bills.

However, through Propositions 60, 90, and 19, eligible homeowners can transfer their current property tax base to their new residence, maintaining lower tax payments.

Let’s take a closer look at how each proposition works.

Propositions 60 & 90: The Original Tax Transfer Programs

Before the introduction of Proposition 19, Propositions 60 and 90 provided a way for homeowners 55 and older to transfer their property tax base under certain conditions.

- Proposition 60 (1986): Allowed homeowners 55 and older to transfer their existing property tax base to a new home within the same county, provided the new home was of equal or lesser value.

- Proposition 90 (1988): Extended these benefits to a different county, but only if the receiving county agreed to participate.

Limitations of Propositions 60 & 90

✔️ Only available one time per homeowner

✔️ New home must be of equal or lesser value

✔️ Limited to participating counties

While these propositions helped many homeowners, their restrictions on location and property value often made them impractical for those looking to relocate to a different county or purchase a more expensive home.

Proposition 19: A Modern Solution for Homeowners

Implemented in April 2021, Proposition 19 expanded the tax transfer benefits, making them more accessible and flexible.

Key Benefits of Proposition 19

✔️ No County Restrictions – Homeowners can now transfer their tax base anywhere in California.

✔️ Multiple Uses – Instead of a one-time benefit, eligible homeowners can now use it up to three times.

✔️ Higher-Priced Homes Allowed – Homeowners may purchase a more expensive home and still transfer their tax base, with adjustments to account for the price difference.

✔️ Expanded Eligibility – Now includes severely disabled individuals and those who have lost their homes to wildfires or other natural disasters.

How Proposition 19 Works

If a homeowner purchases a more expensive home, their existing property tax base transfers to the value of their old home, and only the price difference is subject to the new tax rate.

Example Scenario:

- Current home’s taxable value: $400,000

- Current home’s market value: $1,000,000

- New home purchase price: $1,200,000

Under Prop 19, the homeowner would:

✅ Transfer the $400,000 tax base

✅ Pay the standard property tax rate only on the additional $200,000

This significantly lowers the property tax bill compared to a full reassessment on the entire $1.2 million purchase price.

Important Considerations for Prop 19

📌 Homeowners must file a claim within 3 years of purchasing the new property.

📌 The new home must be the primary residence (no vacation homes or investment properties).

📌 If purchasing a less expensive home, the entire tax base transfers with no adjustments.

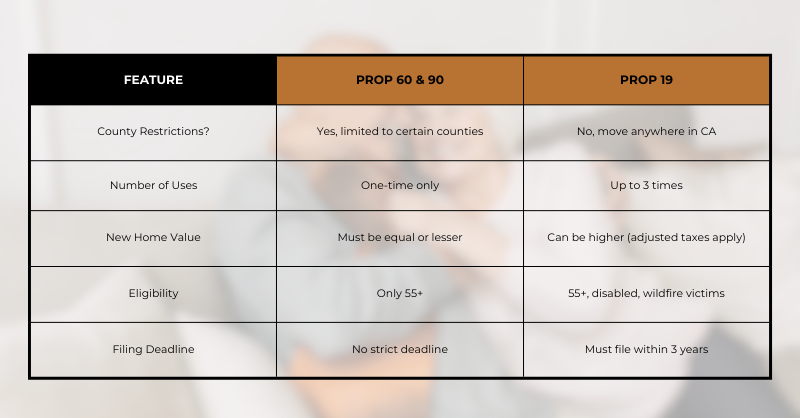

Comparing Propositions 60, 90, and 19

.png?w=1140)

Final Thoughts

The ability to transfer a property tax base can be a game-changer for California homeowners looking to relocate without facing dramatically higher tax payments. Proposition 19 has made this benefit more accessible, allowing homeowners greater flexibility when choosing their next home.

The Walker Team of Intero is here to help

Our team is dedicated to ensuring you make informed real estate decisions that maximize your financial benefits.

.png)

.png)

.png)

.png)

.png?w=128&h=128)