3 Positive Things About the Current Real Estate Market

News about the economy and real estate market can be stressful. Inflation, interest rates, the housing crisis… yikes. If you’re trying to buy or sell a home, all this negative, rapid-fire information can feel overwhelming—and it’s easy to feel like you shouldn’t get into the market at all.

But if your goals include buying or selling a home in the near future, you should know that there are significant plusses to doing it now. Read on for three notable positives about the current real estate market.

1. Listing now means less competition.

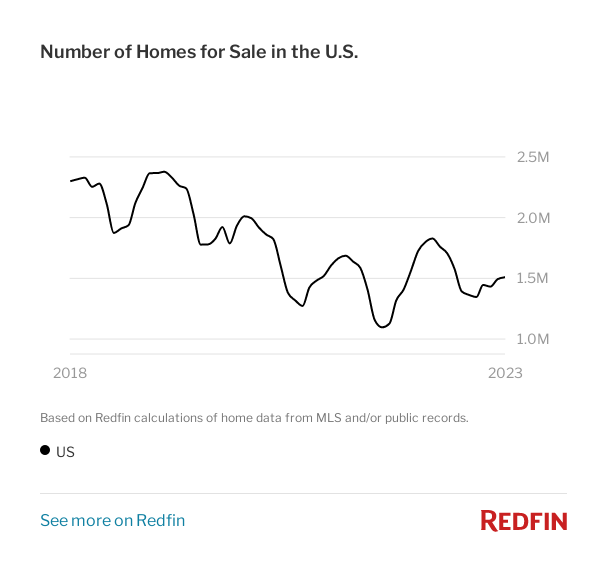

A major problem for buyers in the housing market right now is low inventory.

What’s inventory? It’s the number of homes available for sale on the market. U.S. inventory is up slightly month-over-month, but is down 12.5% year-over-year and down a whopping 36% since this time in 2019.

Source: Redfin

For buyers, low inventory can mean high competition, high prices, and a struggle to find a home that suits their needs. But for sellers, low inventory is beneficial. If you decide to list your home now, you’ll have more buyers vying to purchase your property than if you wait. And with more buyer competition, you’re more likely to get full-price offers and sell on your timeline. In a low-inventory market, sellers are in control—so get listing!

2. Buying now has multiple benefits (yes, really!)

Even though low inventory makes house hunting more difficult for buyers, buying a home now still has more benefits than trying to wait out tough conditions.

For one, there’s no telling how long certain market conditions will last, and overall, real estate prices rise in the long term. There’s no market crash on the horizon right now, so waiting for interest rates to go down or prices to drop could result in you facing even higher home values in the future.

Instead, it’s smarter to get into a home now and start building equity.

What’s equity? It’s the difference between the value of your home and the amount you owe on your mortgage. It’s gained as you make payments on your loan at the same time the value of your property rises, and it represents the amount you’ll get back when you eventually sell. The more equity, the better—and investing in your own home now means you will benefit from rising prices in the future instead of struggling with them.

Still worried about mortgage rates? In most cases in the U.S., “you can deduct all of your mortgage interest” (Publication 936 (2022), Home Mortgage Interest Deduction, IRS) when you file your tax return. If your personal finances support a home purchase at this time, go for it, deduct the interest, and refinance later when rates drop.

3. Strong home prices are good news for the economy

Plunging home prices are one classic sign of an economic recession—one that, so far, we’re avoiding. The U.S. is expected to narrowly dodge a recession this year thanks to the strength of the labor market and consumer spending, and strong home prices are an indicator that the economy is still headed in the right direction. Better still, experts don’t predict that prices are going to drop any time soon.

Though declining home prices would be a welcome break for many buyers, the overall implications of rapidly falling home prices aren’t good for anyone. The recession that usually accompanies dropping home values includes widespread job loss, wage growth shrinkage, and home foreclosures. The fact that home values are steady is a good sign that we’re likely to avoid these problems in the near future.

If affordability is a concern for you as it is for many buyers, reach out to your real estate agent to ask about your options. If you’re a first-time homebuyer, many programs exist on the federal, state, and local levels to help you make your first home purchase. Benefits can include downpayment assistance, lower downpayment requirements, lower-interest home loans, and more.

Contact your real estate agent or trusted lender for more information.

Get into the market.

Stop trying to wait it out and take control instead. If you have real estate goals, we’re the team to help you meet them—no matter what the market is doing.

.png)

.png)

.png)

.png)

.png?w=128&h=128)